Frog Capital’s prime focus is to back the best European software companies once they’ve achieved product-market fit and propel them to further growth with added expertise. A recent report from Cambridge Associates on the Growth market entitled ‘Turns Out, It’s All About The Growth’, provides compelling evidence of why an investor should have growth equity in their portfolio:

- Growth funds outperformed their VC and BO counterparts on a 3, 5, 10 and 15 year period on pooled IRR terms

- Growth equity provides clear upside potential together with less downside risk – it, therefore, offers the best of both worlds for Growth/VC

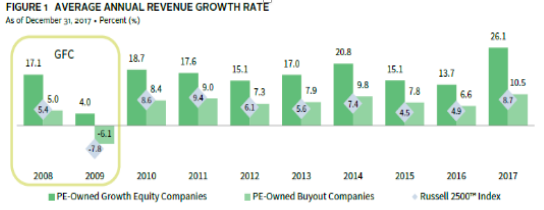

- Growth demonstrates clear revenue growth; av. annual revenue growth of 17.2% (2008-17), 2x that of BO

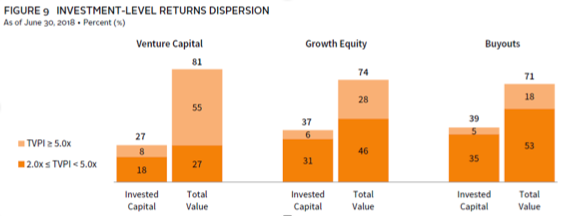

- Growth also provides less downside risk than VC: there was a greater dispersion of returns across the broader portfolio (rather than reliant on high returns from a small sub-set of the portfolio) and less capital loss than VC, more comparable to BO

We put this to experienced investor and entrepreneur, Martin Hauge, who now invests across a range of funds through his own family office and who joined Frog Capital as Chairman after seeing the need for a Scale-Up / Growth investor.

What is your view on how to access Tech investment? And on the different approaches?

My investment approach is based on my experience as a CEO and operator of companies as well as a tech investor, formerly as a General Partner at Creandum and more recently via my own Family Office.

At Creandum, we understood the early-stage market. We produced one of Europe’s best performing funds, by focusing on European technology such as Spotify and iZettle, two of Europe’s biggest successes. I know what it takes at this stage – grand views of the market opportunity, working with entrepreneur, product development – but ultimately it is much riskier and your bets as an investor are spread across many unknown companies. We also had our failures. The recent Cambridge Associates report underlined this point. VC depends on a very small sub-set of its capital invested (8%) to return over the half the total value of the ‘winners’ (e.g. TVPI > 5x). Growth’s value comes from a broader set.

That’s why, as an investor in funds, Growth is also attractive; it provides exposure to the upside but with less downside risk, given companies have traction. Partnering and complementing the early stage is something I look for in Growth managers like Frog.

How do you view the current Growth market opportunity?

Europe’s ecosystem is thriving. I have seen that in my experience, and it remains truer today. However, there lacks the Growth capital in Europe to support the best of Europe coming through. They have it in the US and we have even seen US investors coming to take advantage of this gap in Europe. The pricing in Europe, although rising in certain sectors, is also more attractive.

We have seen various initiatives to try to address this. The latest of which is a European Sovereign Wealth Fund (SWF) to help rival US and Chinese software giants. Ultimately, this endorses that Growth works. That is why the Cambridge report is particularly interesting and opportune. Now is a great time to invest in Growth. There lacks enough managers, however, investing here with the relevant expertise.

What are the important qualities a successful manager needs to invest in Growth?

One of the reasons for becoming Chairman of Frog Capital is because I see the need for a manager like Frog with specific expertise and a framework to support the companies scaling-up. There is a clear differentiation in the skillset and expertise required here vs. at the early-stage. Frog has this.

The Cambridge Associates report is very interesting. Although based on US companies, the principles hold true for Europe. In Europe the opportunity is greater for reasons I have given. The report mentions the importance in post-investment value add capabilities. This is important to maximise the value and potential of the company, provide advice, make introductions and help in a number of key areas such as marketing, sales, strategy and funding. Moreover, specialists have a greater understanding of the sectors they operate in; it therefore makes sense that specialists outperform here too.

There is a clear need for Growth in an investor’s portfolio.

Any worrying trends within Growth?

Growth is by no means risk free. If anything, the expertise required here is greater – less about investing broadly across a number of companies and hoping one returns the fund. This is about access to quality dealflow, good deal selection and expertise to help the companies. So choosing the right manager is as ever key.

I see some worrying developments.

- The dangerous rise of opportunities / winners funds – early stage managers investing in a more concentrated pool of their perceived winners, at a later stage, to not get diluted but with less relevant expertise at the scale-up stage

- Multi-stage and later stage managers are also raising seed/early stage funds – can managers actually deliver on promise to work evenly with those companies they give a small ticket to vs. larger tickets? Moreover, how can managers carry out their fiduciary duty correctly? Surely, they owe more support to a €10m cheque vs. a <€500k cheque?

There is a lot of discussion about Brexit and various negative macro-economic trends. What are your thoughts here and how does it affect your thinking?

As an investor, I am of course looking for signs of when the bull market will end and am conscious of a downturn. Investment is relative. It is about which asset class is more negatively affected and investors always need to invest somewhere to avoid missed opportunity cost, keep up with inflation etc.

Public markets will arguably feel the impact more greatly, seeing greater volatility.

Yet, I still want access to technology, as I view it as a growing sector with long-term potential, and before the public stage which still only sees technology much later.

Arguably, It is largely counter-cyclical; software has greater margins, there are still large markets that haven’t been disrupted and larger companies are responding to this through investment and purchasing smaller tech disruptors.

Therefore, investing in Growth, where there is a mixture of high-growth and high-return potential but proven less risk and capital loss, makes more sense.

The Cambridge Associates data clearly shows. It says lightly levered, growing companies in expanding areas of an economy could prove quite resilient during downturns, with data showing such companies grew revenue and EBITDA even during the 2007–09 global financial crisis (GFC), as you can see from the below chart.