Giving LPs exposure to resilient Software businesses through Frog’s Scale-Up Methodology

I am seeing many similarities in today’s COVID-inspired crisis, as I have witnessed during prior crises as an entrepreneur and investor.

Across my own portfolio and reports from across the industry, there are three groups of portfolio companies emerging:

- Those that will benefit

- Those that will survive

- Those that will fall-over

Due to Frog’s investment focus and operational expertise through its differentiated ‘Scale-Up Methodology’, Frog has a very resilient portfolio. At this present time we have ONLY winners and survivors. Frog’s portfolio of resilient, software companies have performed robustly in the current crisis.

This is why I joined Frog and why I have invested in Frog. It is also why I remain very optimistic about both European Software and Growth Equity. Rather than firefighting and/or channelling our funds into emergency rounds, we can look deep into new opportunities.

Frog’s Differentiated ‘Scale-Up Methodology’ & building ‘resilience’ across the portfolio

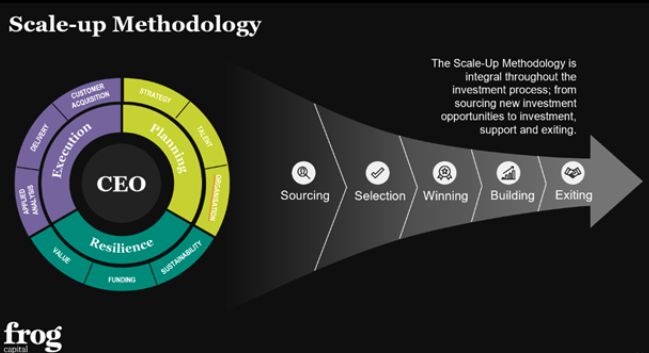

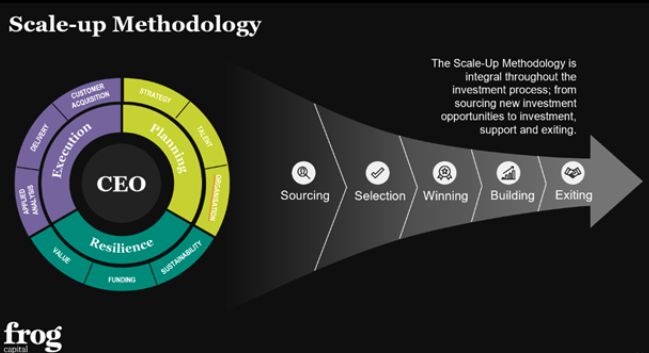

The Frog team has designed a highly effective ‘Scale-Up Methodology’, informed from the team’s experience across Private Equity and PE backed businesses, as investors, entrepreneurs and Operating Partners. This defines Frog’s philosophy and provides a framework which is used across the investment process, from investment through to post-investment portfolio engagement.

There are three main components to the Scale-Up Methodology: focusing on the shorter-term ‘execution’ of the business plan; the medium-term focus on ‘planning’ ahead; and the need to build ‘resilience’ across business longer-term. We see these as mutually supportive: funding and sustainability provide the platform for the confident pursuit of value creation.

Resilience is the ability to cope or even prosper in a crisis; quickly returning to activity that exceeds pre-crisis levels. Resilience exists when a company embeds behaviours to protect itself from the potential negative effects of stressors. This provides it with the solid platform to move quickly to exploiting opportunities. In Frog’s portfolio we see the demonstration of ‘resilience’ and crucially, the importance of long-term sustainability.

Long-term Sustainability

A core part of the Frog philosophy is helping management to build businesses that can become self-sustaining longer term. The most effective scale-up CEOs drive aggressive growth, not at all costs, but by judging their ability to attract the right level of resource to fuel the plan, thereby keeping the destiny of the business in the hands of the executive team.

For a scale-up company with a core profitable business, the options are open to drive good profitable growth from internal funding or to take external investment to support faster growth and losses, with a clear return on the additional investment. Without strong underlying fundamentals (positive unit economics, clarity on breakeven points, revenue visibility), management will be surviving at the whim of funders which at present would be a very uncomfortable place to be.

Portfolio engagement during COVID-19

Akin to the Global Financial Crisis, Growth Equity should endure the crisis better than early stage VC. Frog’s portfolio and the differentiation of Frog’s approach from VC strategies is clear to see in the outcomes through this most testing of times. Frog has worked with all portfolio companies through the investment team & operating partners as part of its broader portfolio engagement. In addition to our Board roles, our Head of Portfolio, Steven Dunne, conducts regular 1-2-1 calls with portfolio company CFOs to stress test proposed COVID reforecasts. Scenarios were formalised to understand which events would trigger each company to move from one scenario to another and what action plans were required in the event of such scenario. Each portfolio company was challenged to demonstrate how they could manage through the crisis with existing cash resources or reliable sources of new funding. Essential and quality planning has resulted in the ability to avoid unnecessary cost reductions, without endangering the validity of the downside case.

Frog’s Growth Equity Investment Strategy – exposure to resilient Software companies

From an LP perspective, in terms of broader exposure within the Private Markets asset class, Frog’s investment strategy provides resilience in a number of ways:

The software sector has outperformed and proven more resilient since the various government responses and lockdown measures (software).

Growth is more resilient than VC which will be seeing a large number of companies going bust; equally, it is not highly leveraged so won’t see the same number of defaults it’s PE peers will.

Frog invests only in software companies that display resilient business fundamentals. It does not back software companies scaling at all costs with a lack of evidence on operational leverage to turn good unit economics in toe profit.

Frog then helps the management team build resilience through its Scale-Up Methodology and Operational Expertise support programme.

The current economic impact from the COVID underlines the importance of Frog Capital’s ‘Scale-Up’ focus. Frog Capital set out through Frog European Growth I (‘FEGI’) in 2014 to invest in capital efficient, high margin software companies with sustainable growth and a clear path to profitability.

Pre COVID, this was demonstrated in the FEGI portfolio of 8 companies had:

revenue growth of >50%

AND

average Gross Margins of 82%

84% of portfolio NAV was profitable and/or funded to profitability

This remains the case today.

Of the detailed portfolio analysis conducted by Frog on liquidity analysis and trading, Frog’s portfolio of FEGI and Frog European Growth II (‘FEGII’) offers resilience together with sustainable growth:

7/9 companies are forecast to show positive revenue growth in 2020

7/9 have high pre-crisis cash to mitigated fixed costs and can trade through to 2021 with little or no revenue, the other two 2 are breakeven (or achievable with easy cost savings) at COVID revenue levels

Looking ahead: the resilience of Software and long-term investment opportunity

Now is a great time to invest in Private Equity and Venture Capital, as pricing resets and innovative companies come through. Investors want to see differentiated managers like Frog whose Operational Expertise and unique Scale-Up Methodology can support portfolio companies and add value across a number of key functions.

There will be significant opportunity for us as investors to support the innovation and change that will ensue. During the Global Financial Crisis when I was at Creandum, we invested in Spotify and iZettle which went on to produce stellar returns in 2018 for Fund II and create one of the best performing funds in Europe.

There will be a paradigm shift across business and consumer habits. Recently, Jack Dorsey, the CEO of Twitter, informed employees that they can continue working at home “forever”. In my native Norway, the largest bank, Nordea, announced a permanent shift to a cashless business model. There will be a greater demand of a greater quality of software to support this shift. Frog has examples of this across the portfolio, such as sofatutor, which has seen a 300% increase in new trials since the crisis, for its remote education software platform. We are excited to invest in such opportunities going forwards.