This article was produced in collaboration with Dave Martin from RightToLeft.

Excellent product is at the heart of scale-up and maintaining momentum and efficiency becomes increasingly challenging as you scale. A common growing pain of scale-ups is in executing excellent product management, but what is “good” and why should it change during the growth of a company? Often, scale-up companies are challenged as to why their product or service is not performing as well as it used to despite nothing fundamentally changing in the product or operations of the business.

As a founder of a SaaS (Software as a Service) business, seeking product market fit will have been a priority. By being agile, quick to react and focussing hard on customer acquisition, you will have achieved strong ARR (Annual Recurring Revenue) growth, high NRR (Net Revenue Retention) and you will be celebrating traction in the market and inevitable scale.

Now, sometime later, you find yourself with a larger team, delegated responsibilities, development working on feature enhancement and a reasonable sales pipeline. ARR is still rising, recruitment is in overdrive, new market opportunities seem to be everywhere and yet growth or value creation feels as though it is not at the pace that it should be.

Why could this be attributed to Product Management?

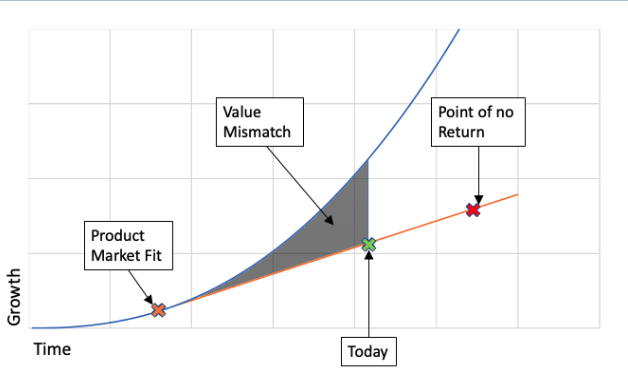

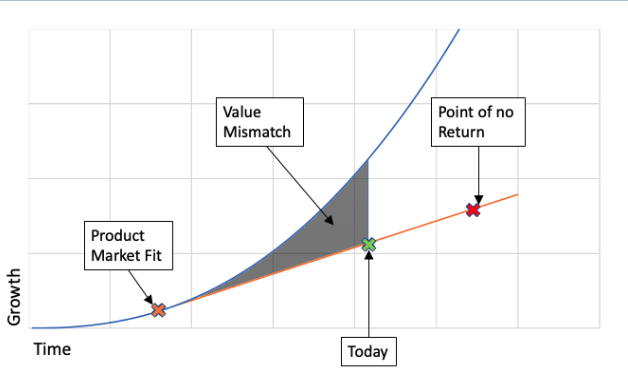

Take a look at the graph illustrating growth over time. Product market fit was achieved early on, but the growth expected (blue line) was planned to accelerate, yet you find yourself at the point of the green X. Growth has been achieved, but not at the rate previously forecast. If the market opportunity still remains, it follows that your product is mismatched to the market that you are operating in.

The ‘Value Mismatch’ area represents the lost opportunity caused by a weaker product market fit. We’ll come on to correcting the growth line, but what symptoms could have indicated that the ‘Value Mismatch’ area was growing?

- Slower ARR growth

- Lower upsell and cross sell results

- Increased customer churn

- Increasing Sales Cycle

- Lead Generation is harder

- Lower conversions

- Decreased ARR / FTE (Full Time Employees)

This is the Product Momentum Gap. If left unchecked, you will reach the point of the red X – the point of no return, beyond which it will be impossible to return your product back to the accelerated growth originally forecast. Customers won’t be getting the features that they were promised, and customer service will be increasingly dealing with frustrated support calls.

What are the causes?

If your product market fit and traction does not follow the blue line then a cohort analysis of these three metrics may well suggest that it is mainly the newer market segments are not sustaining your momentum. Your product market fit in the original sectors holds true, but as you have expanded the market the fit has become weaker.

It is often very hard to spot because it is actually the rate of change of these symptoms that are the pointers to a worsening Value Momentum Gap.

Expansion plans

A common approach to growth is market expansion, for example moving your product into new segments or indeed internationalising your product. After all, you have demonstrated a problem in the world that you can solve, so why wouldn’t your product work elsewhere?

And so, as your company grows you take your product into adjacent markets. Growth is slower, but this may be attributed to nascent market development and actually not recognising that the Customer Value requirements in these new segments are different to where you have operated previously.

Dave Martin, Right2Left

Having been laser focused on growth in the early days, you may have customisations and nuances that are not obvious and that make it specific to the segment where you achieved your product market fit. Product development will probably have been concentrated on closing deals, and so indeed your actual product proposition, while highly relevant to original segments, is less attractive to the newer broader markets.

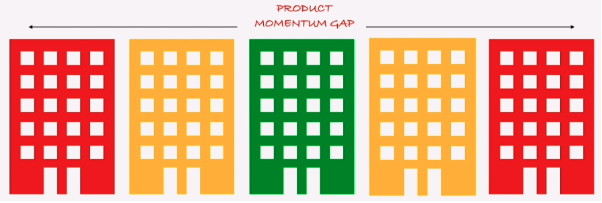

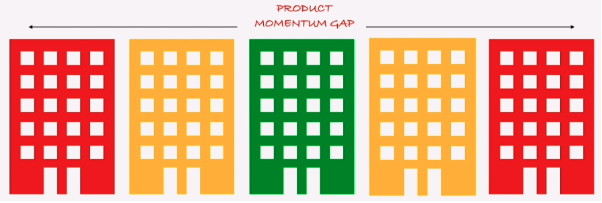

A common reaction is to go broader still, but that actually compounds the issue of slower growth, evidenced by longer sales cycles and lower conversion rates, for example. The business will be stretched, product decisions may be reactionary, and focus will be increasingly switching, reducing output from engineering, and slowing down product development even more. In the illustration below, the outer markets are red because your original solution is not relevant there.

Dave Martin, Right2Left

Understanding Value

So how can Product Management move us back to accelerated growth? Understanding what constitutes customer value and how that intersects with your business strategy will inform both the target markets and product requirements in those markets.

Having product market fit in one sector doesn’t mean that you will readily find it in another sector. When you are looking to expand into new markets immediately engage your product team to look at the challenges, the problems, and the nuances that the particular segment are faced with. Understanding this will then inform your teams how to measure what matters – i.e. the customer value of that market – and then take measured and sensible product decisions to further your reach in each market.

Dave Martin, Right2Left

Formalising this process results is a much better way to scale efficiently. By learning about the new problems in new markets, your product team will design solutions to overcome them. Traction in new markets will be swift, evidenced by the turn in metrics described earlier such as NRR or sales conversions.

Most importantly, you will now have a repeatable process that you can then take into the wider market opportunities with the confidence of strong product market fit and a return to accelerated growth.

Conclusion

Having product market fit in one sector doesn’t mean that you will readily find it in another sector.

When you are looking to expand into new markets immediately engage your product team to look at the challenges, the problems, and the nuances that the particular segment are faced with.

Your actual product proposition, while highly relevant to original segments, may be less attractive to newer broader markets.

Understanding what constitutes customer value and how that intersects with your business strategy will inform both the target markets and product requirements in those markets.