The Q1 2022 Tech correction has undoubtedly taken much of the hype out of the technology market, but it is also clear six months later that the software market is so large now that different sub-categories have been impacted in different ways.

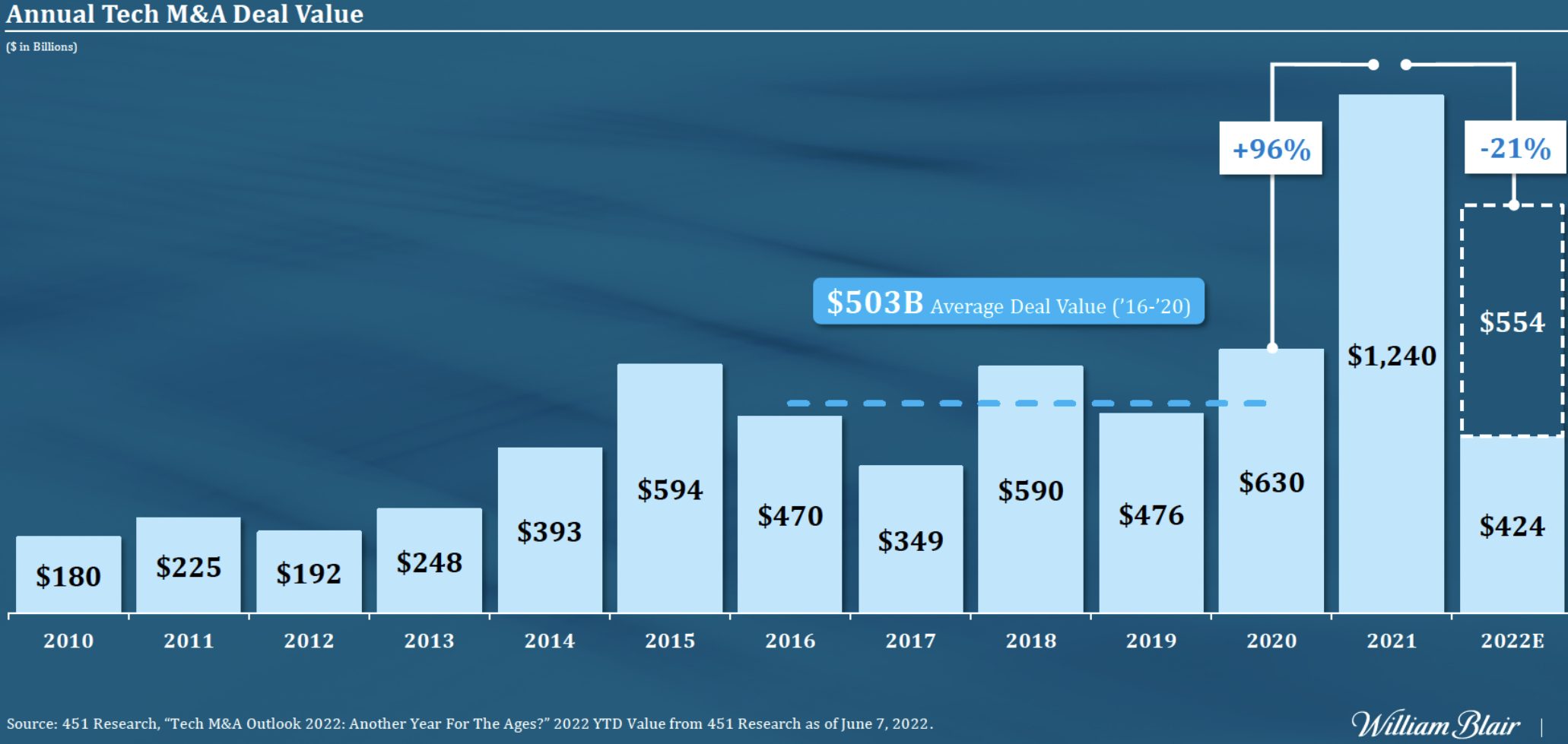

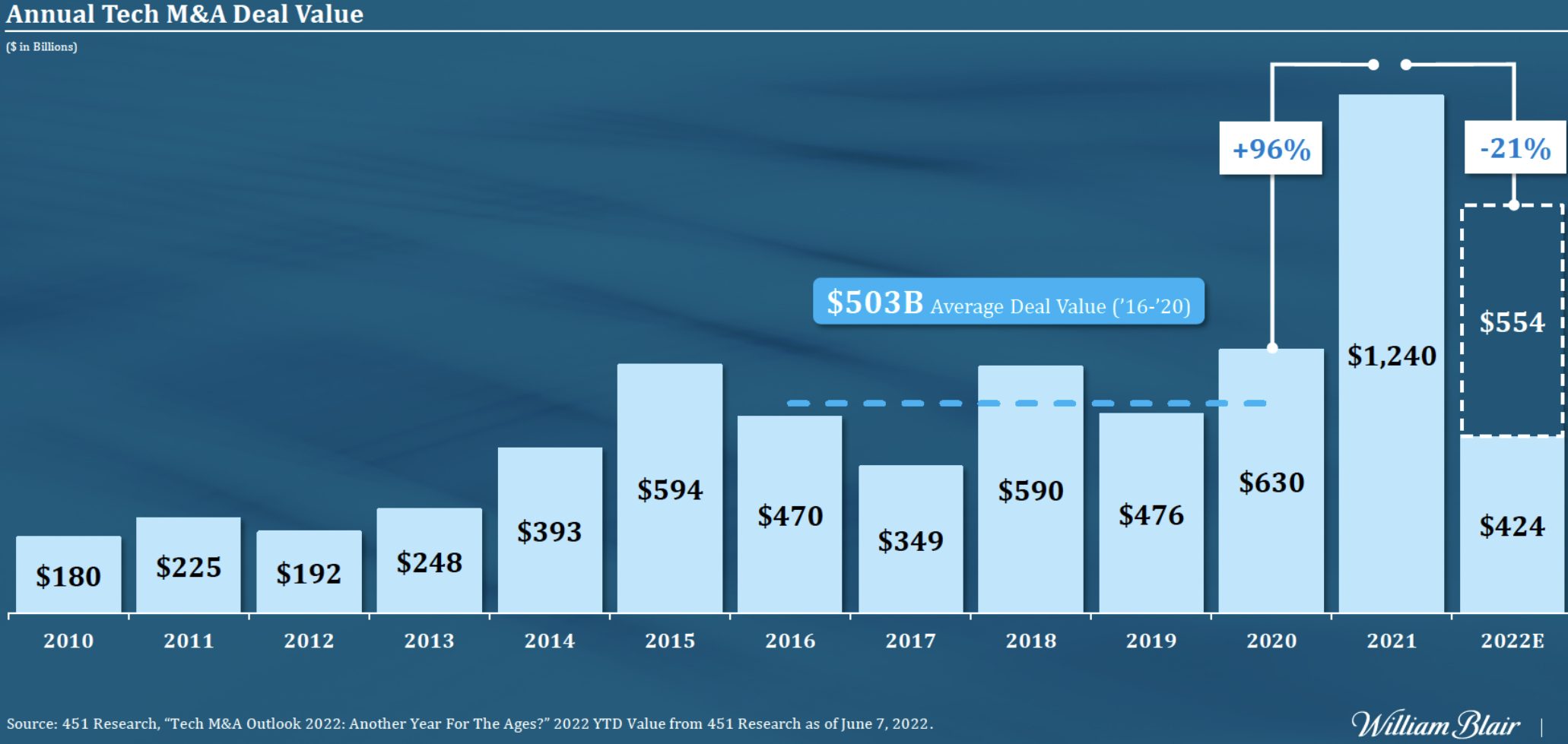

Tech M&A had been averaging circa $500bn per annum since 2015 up until a bumper 2021. With Tech M&A at H1 2022 being $424bn, 2022 looks like being an above average year, but it is worth diving deeper into the key learnings to date.

The headlines we have all read with falls of 50%+ have been largely confined to hyped SPACs or ‘Growth at all costs’ strategies. Quoted markets are clearly bruised by this experience and therefore new IPOs are facing considerable uncertainty even if their quality of earnings are strong.

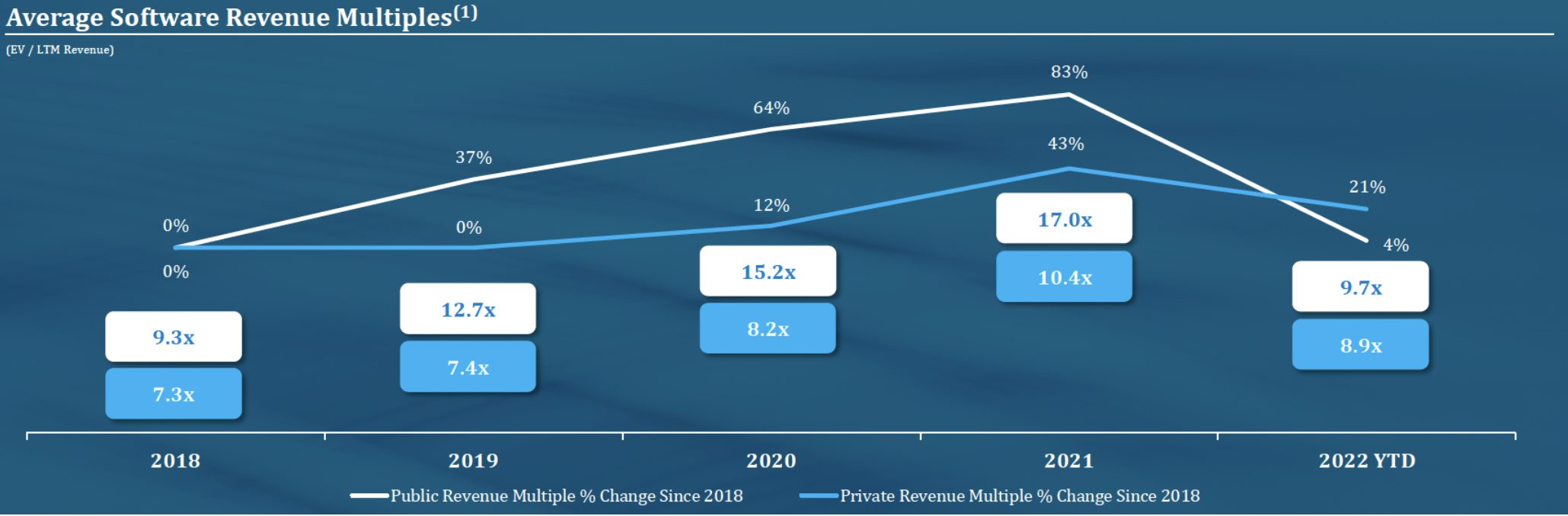

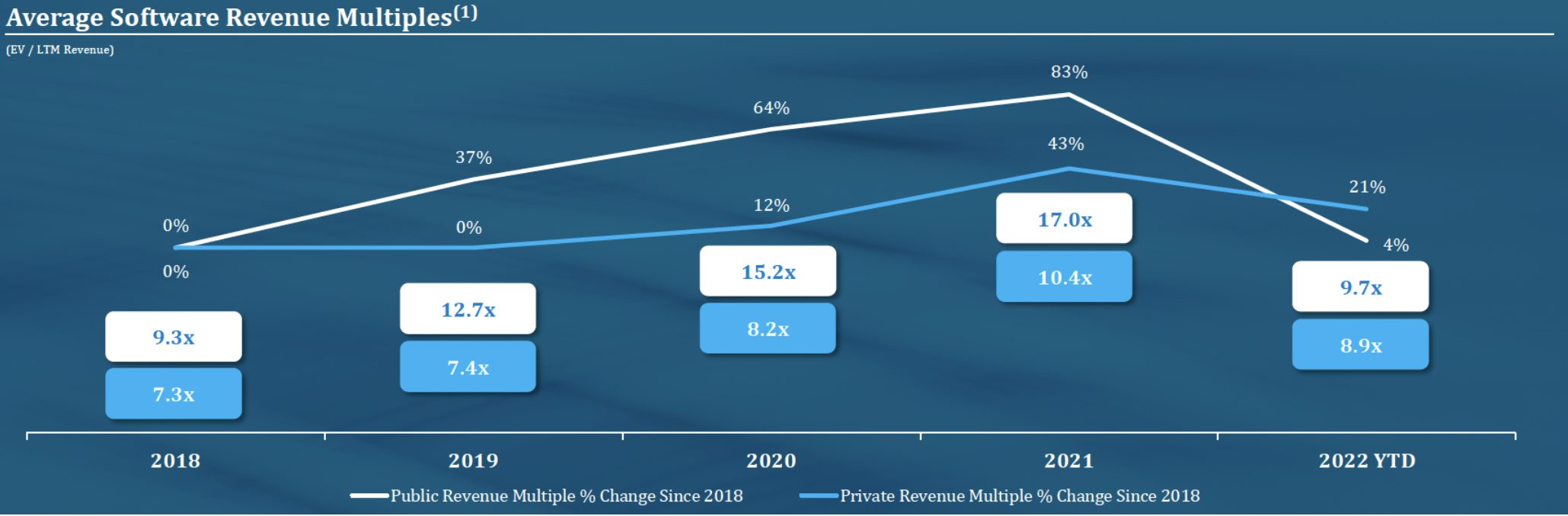

Outside this sub-category, the story looks more promising. Average software revenue multiples in the private sector never rose as high as the quoted markets and have correspondingly (so far) been comparatively steady.

There are four core drivers to this:

- Volume

- Maturity

- Modernisation

- Private equity

Despite the tech correction in Q1 2022, deals are still happening. At Frog, we have closed two exit transactions in H1 this year. There is a demand for good software companies and this is providing an attractive floor in valuations despite the headlines. The maturity of the software market is at a different stage now than it was 10-20 years ago. It is now a far larger market with a broader range of profitable and near-profitability companies.

What does good look like?

This demand from acquirers is based on fundamentals, not based on froth. Operating on old or poorly designed software is extraordinarily frustrating now that we are all used to high performance mobile devices. A weak digital proposition attracts security issues, churns existing customers, fails to attract new ones and results in higher labour costs due to high training costs and error rates. Modernising ones software infrastructure is simply a good investment. Entrepreneurs scaling new software offerings are clearly aware of this, but so are M&A strategic acquirers, with the recent example of Ascential Plc buying Frog’s portfolio companies Sellics GmbH.

In addition to strategic buyers looking to ingest more modern software teams and their expertise, private equity has also become a major player in the market. Whilst private equity firms are still buying software companies in classic MBO style deals, it is the PE-backed trade platforms and their aggressive buy & build strategies that are sustaining the volume of activity in the market. Larger PE players like Hg Capital, Apax, Nordic Capital, CVC and the bigger growth capital players like General Atlantic, TA and Summit are targeting key verticals and bolting on companies to build out product suites and/or expand into new geographies. The acquisition of Frog Capital’s portfolio company, Azimo, is an example of this as it was acquired in H1 2022 by a Papaya Global backed by Bessemer, Insight, IVP and Tiger Global.

In summary, the software M&A market valuations may fluctuate, but due its scale and maturity we expect activity to continue for well run assets. With the right investment strategy of building companies that appeal to these audiences, we believe the outlook remains bright especially as entry valuations are attractive.