Not everyone can build a unicorn. Only a handful of companies have sold for $1 billion plus. The majority sell for less than $200 million dollars, which isn’t a sum to be sniffed at.

Our definition of success is becoming far too distorted and, as a result, real, lucrative opportunities are being missed.

So, let’s stop chasing fake unicorns. They are the stuff of fairy tales. Let’s learn to build real racehorses first and then we can play with the fantasy.

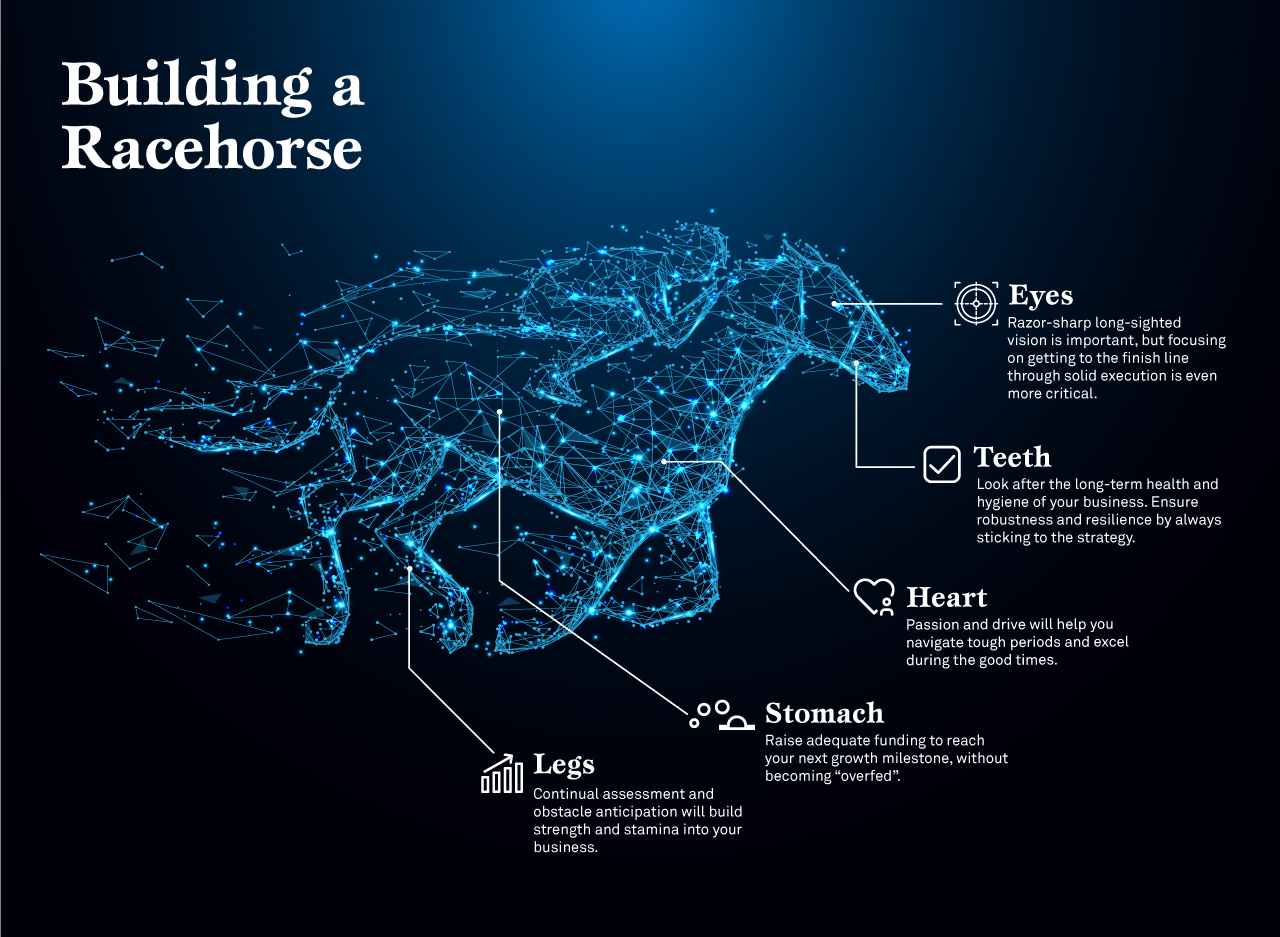

Racehorses are resilient and profitable scaling businesses, built on solid foundations and strategically managed. Just like a finely tuned machine, they offer consistently strong and reliable performance throughout their course, with plenty of wins along the way.

Here’s how to nurture your own technology racehorse:

Don’t be deluded

There is a long road from an idea on a napkin to a fully-fledged unicorn. Some founders set out believing they have a unicorn and go and raise lots of capital to support it. Then, they inevitably become so deluded by this unicorn promise that they forget they are building a business that needs to deliver shareholder value. I call these “manufactured unicorns”. If every value creation milestone is reached solely through fund raising, this is not true ROI and, quite frankly, this is not a viable business.

Raise for a reason

Racehorses can be ambitious but they are always in control. They raise funds realistically with an end-goal of profitability – enough to reach their next value creation milestone without being “overfed”. There is no point scaling too early and burning through a lot of cash, just for the sake of chasing unicorn valuation.

Value means something different for every business – whether that’s higher revenue or expansion into a new sector. The important thing is to keep an eye on your vision and take calculated steps to get there through execution and strategy.

Being focused on the road ahead shouldn’t mean an isolated approach. Support and mentoring is something I advocate at all levels of the organisation, wherever it’s needed.

Think long term

Strength and stamina are essential to ensure consistent performance in the long term and drive for results. Having a robust and strategic plan of action allows racehorses to continually assess their staff, management structure and process so they can anticipate upcoming issues. A smart VC will know when to help with this and when to get the hell out of the way.

Show your ambition

Relentless drive and passion are what will get a CEO and most companies through really tough times and they will help them excel in the good times. A CEO without passion is a dead CEO in my opinion. If you are not passionate about your business or cannot demonstrate it then do everyone a favour and hire a CEO who is.

Quit on a high

In terms of exit strategy, knowing when to quit is a skill that quality investors should value more in their portfolio companies. Technology moves fast and every product has its shelf-life. Either you have to continue churning out new products to get the right product-market fit; or you can recognise that your high-growth curve is beginning to slow down. A racehorse will quit at the top – when there are no more gold medals ahead of them.

Exit at the top of your game and not only can you go for the highest possible price, but you can continue to win in the future.

Make realistic promises to your investors

When I sold Arieso for $85m, we were able to deliver a fantastic outcome for investors, myself and management, which is really the point of a racehorse. The company was profitable and growing at 70% CAGR. It became the fastest growing business unit of its acquirer, which meant a very happy acquirer, great career progression for your key staff with the legacy continuing to this day.

Whether you’re selling for $50m, $500m or $5bn, you can only call yourself a successful entrepreneur if you managed to deliver the value you promised to your investors, employees and any other stakeholders. I personally get worried when entrepreneurs try to raise silly amounts of capital at massively inflated valuations promising the world and when it goes horribly wrong, they end up losing what could have an amazing racehorse if only they had been more realistic.

Most importantly: racehorses can become unicorns

Start with the mindset of building a racehorse – create a business with solid foundations and resilience. Raise what you need to create the next big value inflection point for you and your investors and if you can or want to keep going and that eventually gets you to unicorn status, then you’ve built a real business and, dare I say, a real unicorn.