In this post on our series on growth investing, we are looking at how leading KPIs shape the prospects of growth companies.

One great privilege of investing in growth stage companies is the availability of historic data, as all companies at this stage have successfully outgrown the start-up phase. Yet while revenue metrics are a decent indicator of past successes, they tell us very little about the future prospects of a company. You have to look at trends, and you have to look at leading indicators for future revenues and profits.

Therefore, at Frog we always look at unit economics and its constituents. For businesses with repeat purchases, one of the critical constituents of unit economics is the customer lifetime value (CLV). It’s often quoted, but we also regularly encounter some unmerited creativity in this metric.

One such creative short cut lies in the oversimplification of the CLV calculation. Simply adding up the expected revenue over a customer lifetime has charm simplicity. And if you are a SaaS company with 90%+ margins, basing your CLV calculations on customer revenue might be an acceptable approximation. It is a different picture, though, if you are an e-commerce site with e.g. 25% margins, as this approximation might lead you to ruinous decisions.

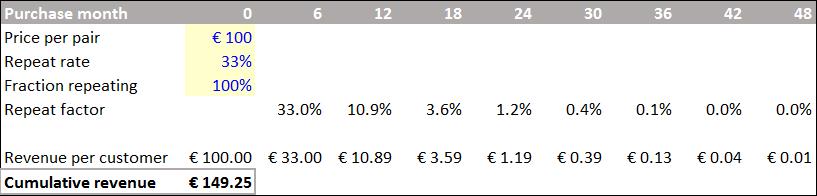

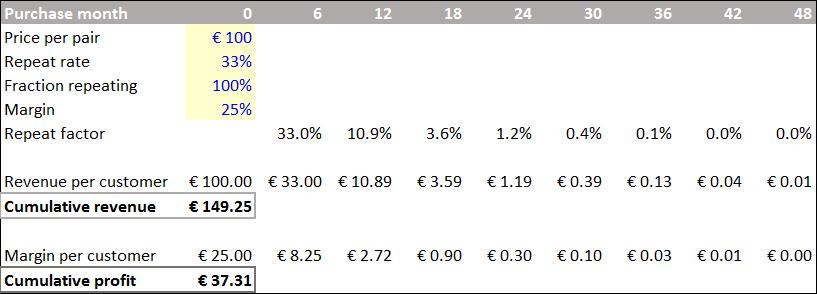

Consider this example: Repeating customers buy a pair of shoes from you twice a year, with 33% of customers repeating from one purchase to another. These shoes are nice ones and cost €100 a pair and you make a 25% on each purchase. So, how much should you pay to acquire this average customer? Let’s look at the example below:

By looking only at the revenue generated from an average customer, you might conclude that €50 acquisition costs would allow you both to be profitable on first order and to earn back your acquisition costs three times over four years. Sounds good, doesn’t it? I’m sure you are sensing where I am going with this. And obviously, the picture changes dramatically when we take into account profit margins:

Jubilation turns into consternation as you realise that customers acquired for €50 will never be profitable. Forget raising money from Frog, your business isn’t sustainable!

If you want to go deeper on this topic, there are many great blogs out there that provide more insight on CLV. I particularly like the following one.

https://blog.kissmetrics.com/how-to-calculate-lifetime-value/?wide=1

This is just one placative example of how growth businesses could and should use data to inform business decisions that enable them to scale up further.