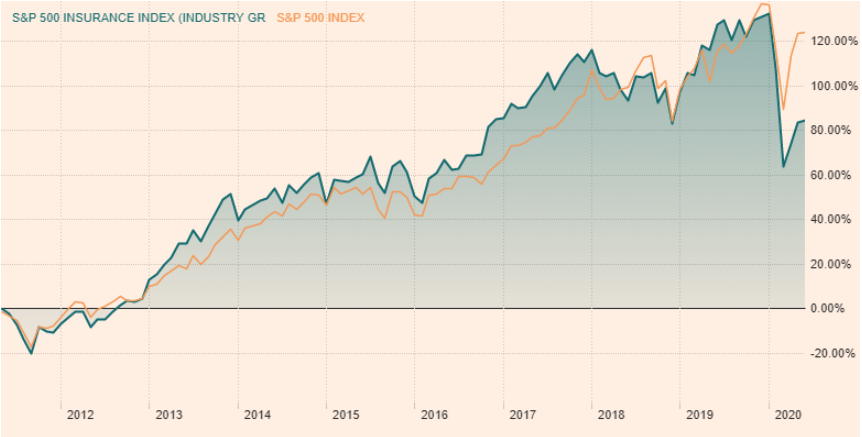

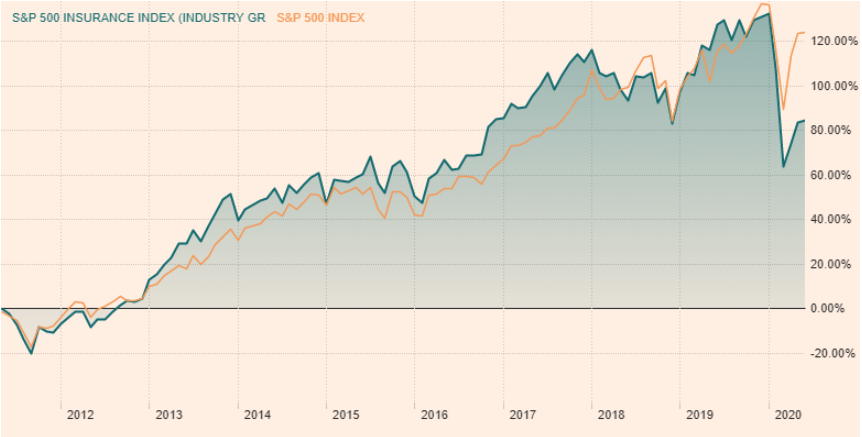

The insurance industry is a large and resilient market, having performed steadily through multiple downturns. It is one of the software sectors within FinTech that Frog follows closely, and that Frog believes has the potential to outperform in the longer run.

S&P Insurance Select Industry Index

Whilst resilient in the long term, we believe this crisis will be a catalyst for change in the insurance industry; providing the critical moment of shift for consumers or businesses to change their behaviour and adopt more efficient or convenient methods using software.

COVID catalyst

One immediate example is the greater uptake in the Lloyds of London ‘PPL Platform’; a digital platform to create and agree insurance policies between brokers and underwriters. Given the restrictions of COVID, the PPL platform has gone from being used for about 970 policies per week in 2019 to almost 3,500 today[2]

In 2019 alone, there was a total of $6.4bn of funding to InsurTech globally, following a record-breaking $2bn of funding in Q4 alone. This represents 34% of the historical total, underling the recent step-change in activity before COVID-19.[3]

“2019 was the year when individual InsurTechs began to come to the fore to lead in specific parts of the market.” – Dr Andrew Johnston, Global Head of InsurTech, Willis Re[4]

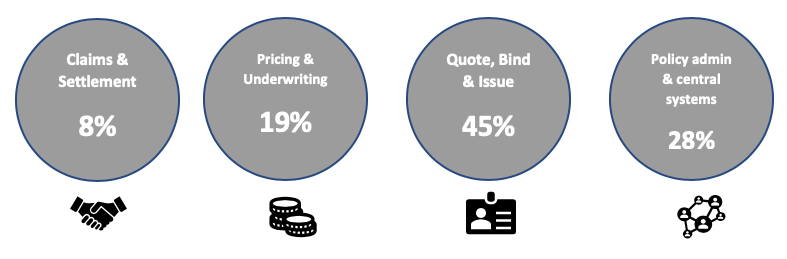

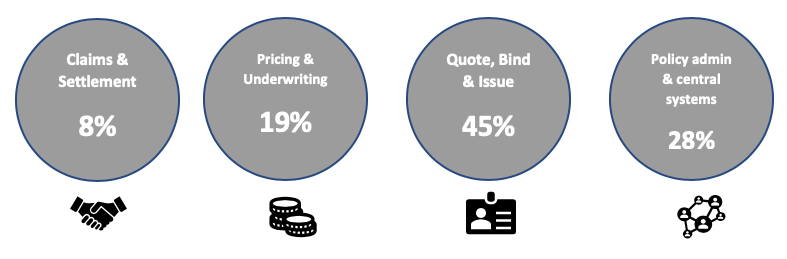

The sectors and sub-sectors of InsurTech

Of 760 InsurTech companies that raised funding in 2019, the number of companies which received funding can be split into the following business functions and areas of insurance:

Frog’s approach is to break down the sector into its sub-sectors, and to understand the most suitable areas for Frog where its fundamental investment characteristics can be found. Frog is looking for market areas displaying the following characteristics.

- Market areas displaying promising Porter 5 Forces dynamics – low supply & customer side power, minimal alternatives, and situations where the larger incumbents find it difficult to manoeuvre due to legacy systems or business models.

- Scalable software & data models, enabling the ability to scale rapidly

- Business models with evidence of robust gross margins and customer acquisition dynamics (e.g. LTV:CAC ratios)

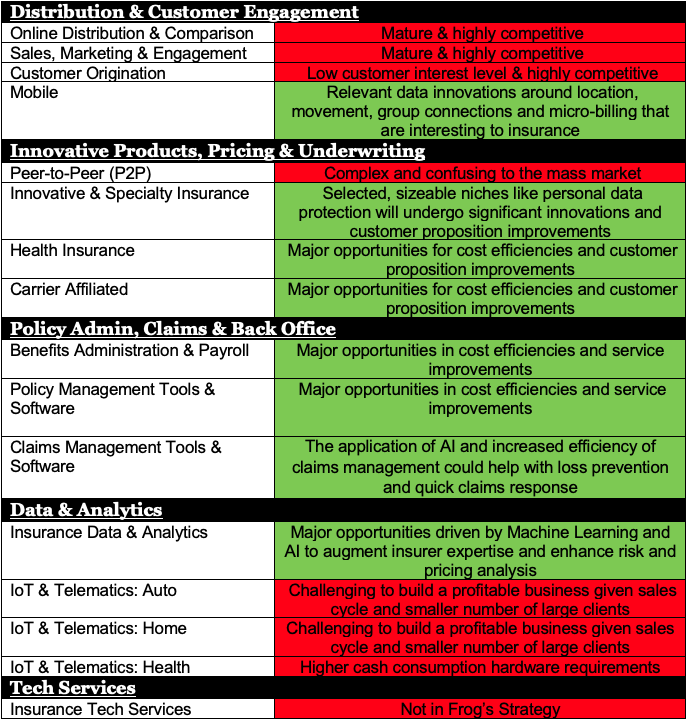

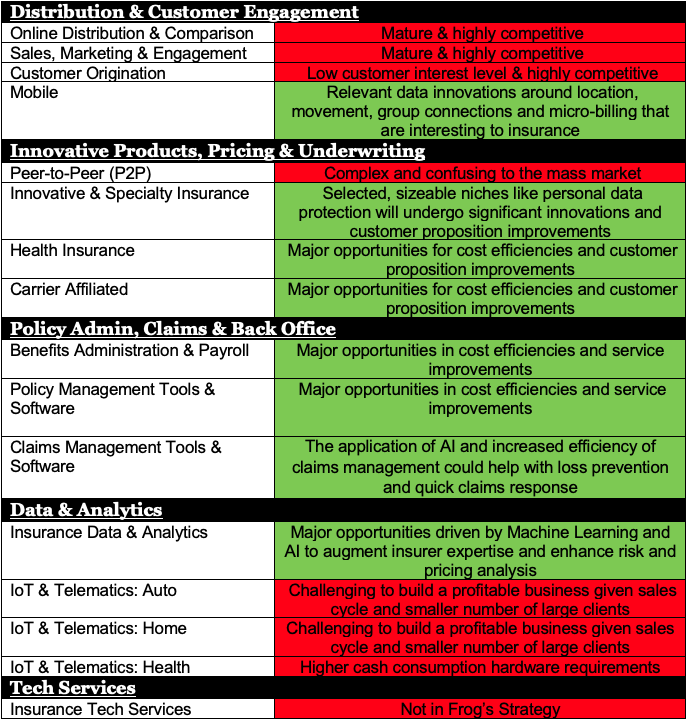

Our high-level analysis is currently as follows:

Distribution & customer engagement

Full stack insurance providers and new insurance business models have emerged to sell and administer insurance policies and products purely online – using mobile and web applications as the modern interface with customers. This reduces costs compared with traditional models but still requires multiple business functions and back end support services to deliver the business.

Taking on large incumbent insurers and brokers requires significant capital expenditure; large marketing spend incurs significant losses for an extended period.

The full stack InsurTechs continue to raise the most money and are the most capital intensive. In Q4 2019, there were four megarounds (>$100m) for Bright Health, Next Insurance, Duck Creek Technologies and WeFox Group.[5]

There are emerging digital insurers focusing on more specific segments of the market that may be interesting (this overlaps with ‘innovative products’ – see below) but largely digital insurers have focused on broad areas; Thimble for SMEs, Cuvva for Car Insurance, Lemonade for home insurance, Bought by Many for Pet Insurance.

Front-end, customer facing InsurTech solutions have so far remained un-differentiated and within a very competitive area, where incumbents have already monopolised the market.

Innovative Products, Pricing & Underwriting

Pricing and underwriting are the main competencies and functions of insurance. Traditionally, insurers would ingest data manually and underwrite risk based upon customer data and based upon actuarial statistics. There is an opportunity here for AI to provide effective analysis to support the underwriting process, by ingesting large amounts of client data and supporting underwriting decisions to lead to better pricing and more appropriate insurance policies. Frog is seeing solutions to help insurers better manage their data and make value of it.

Frog has seen a number of interesting businesses within this space. The challenge will be the uniqueness of data sets and heterogenous nature of insurance where there are numerous lines of insurance, markets and geographies all with particular nuances. Speciality and bespoke products are starting to emerge.

Niche InsurTech solutions that are differentiated to traditional insurers or brokers focusing on speciality lines of insurance or core areas within insurance are of interest. Here, there is less competition, greater capital efficiency and potential to scale.

While the concept of Peer-2-Peer is as old as the industry itself, this is a relatively unknown and new development, with a number of new entrants like Lemonade and friendsurance, adopting different approaches and whose business models are complex. As with most P2P concepts, the model depends on network effects of larger marketplaces and number of policyholders / users, which require large marketing budgets and is generally very competitive.

Policy Admin, Claims & Back Office

Frog is seeing wider innovation and opportunities in such areas as Claims & Settlement and Insurance Underwriting / Pricing Analytics, where existing insurance processes delivered by people can be augmented and supported by software.

There is a clear demand and requirement of both insurers and brokers to support their customers through enhanced customer engagement and a better experience, through the use of chatbot technology and live streaming video technology. They can also understand the client better, which leads to greater pricing accuracy and a reduction in fraud. But ultimately, the chance to pre-empt loss and facilitate quicker response which culminates in reduced payout and loss to the insurer.

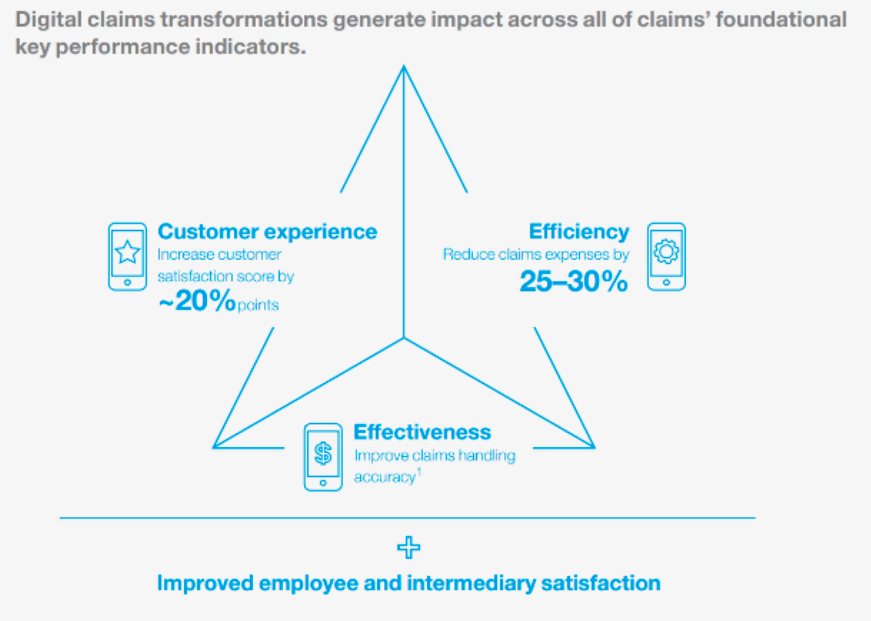

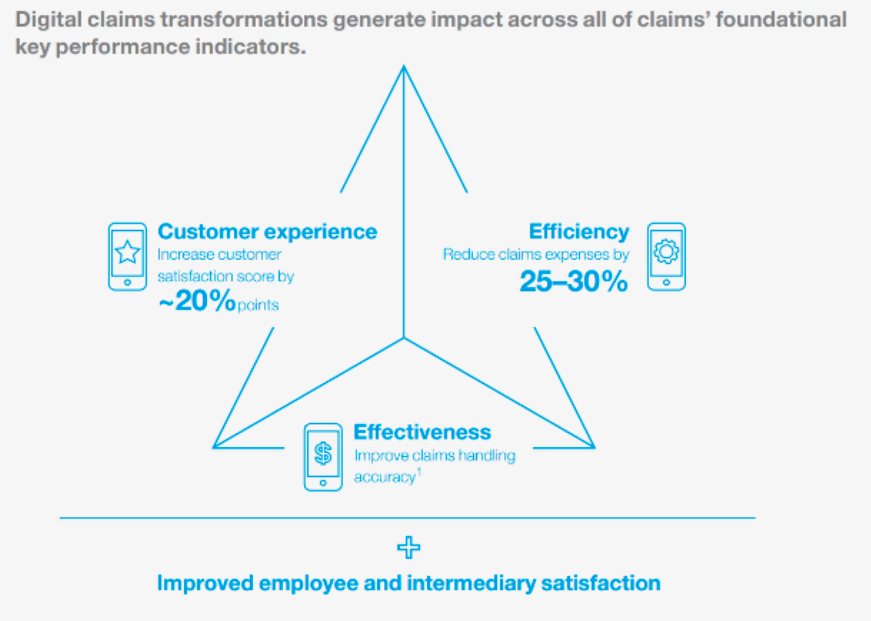

As McKinsey highlights in their Digital Insurance survey, digital transformations are generating a positive impact for all stakeholders across claims’ foundational KPIs: [6]

- Customer experience – better customer satisfaction

- Efficiency – reduced claims’ expenses

- Effectiveness – better claims handling accuracy

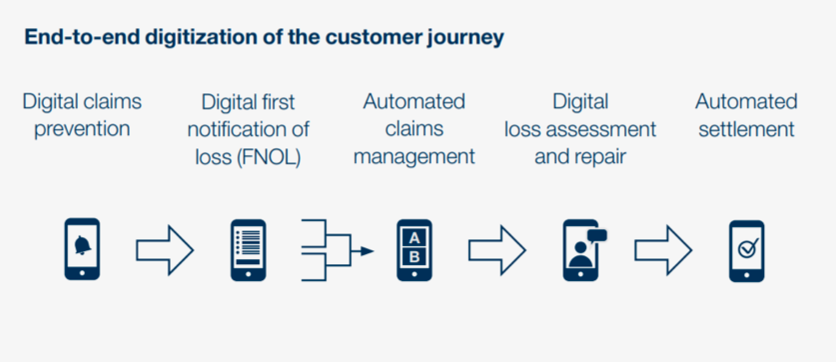

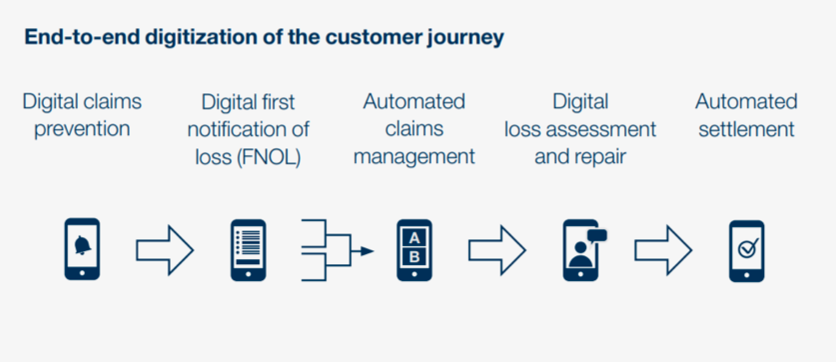

The entire customer chain has the potential to be improved through software, as the following iconograph details.

Within this space Frog has seen clear processes and systems that can be improved by new software solutions and which are of critical importance to the insurance chain.

Data & Analytics

New hardware is enabling insurers to monitor behaviour, track in real time various measurable inputs, respond to claims, and manage responses to customers. This is valuable data that drives the risk / return dynamics of insurance. This allows insurers to improve their pricing and risk profiling to ultimately reduce their costs and improve returns. From the connected car, to the smart home, there are live inputs and connected devices that provide valuable data and insights for insurers.

Conclusion:

In summary, the InsurTech market is a large market with great potential for continued software innovation and further disruption, but which has been hampered by a slow pace of change and progress by few InsurTechs in limited areas. Frog sees a resilient insurance sector with a lot of capital and large M&A budgets, whose interest in new software is increasing.

Frog will continue to assess the InsurTech market, to understand the dynamics and see which areas remain promising, as we assess new deals coming through our deal-sourcing pipeline. Frog’s assessment will continue to evolve alongside such external factors as pricing, the quality and number of companies emerging, together with the right timing within insurance evidencing take-up by insurers/brokers.

Footnotes

[2] Financial Times, ‘Old school trading under threat as insurers rethink life at Lloyds’, May 2020

[3] Willis Towers Watson, ‘InsurTech Briefing Q4 2019’, January 2020

[4] Willis Towers Watson, ‘InsurTech Briefing Q4 2019’, January 2020

[5] Willis Towers Watson, ‘InsurTech Briefing Q4 2019’, January 2020

[6] McKinsey, ‘Digital Insurance in 2018’, December 2018

[7] McKinsey, ‘Digital Insurance in 2018’, December 2018