Why Investors need Growth in their portfolio?

A recent report by Cambridge Associates entitled ‘Growth Equity: Turns Out It’s All About The Growth’ reveals Growth Equity not only provides less risk than Venture Capital, it also provides exposure to comparable upside growth, and has actually outperformed VC and Buyout fund returns over the last 15 years.

It provides clear justification to investors for investing in Technology to gain exposure to high-returns, while maintaining less risk, particularly when facing certain macro-economic headwinds.

This was reflected at the latest European PE Forum. Christophe Bavière, CEO of Idinvest, a large private markets investor, said the typical investor is “under-allocated to PE, under-allocated to Europe and under-allocated to ‘innovation’ (i.e. Tech).”

Tech staying private for longer and outperforming

Technology outperforms in the public markets. The Stoxx600, for example, provided annualised returns of 2.1%, 7.8% and 6.4% over a 1, 3- and 5-year period. However, the Stoxx Europe 600 Tech Index produced higher returns of 5.2%, 12.7% and 13.4% over the same period. This is matched by the NASDAQ and other leading tech indices.

However, as a sector, technology and software is still underrepresented by leading European public indices. For example, just 5% of the Stoxx600 is allocated to technology.

To reap the reward and get a return, however, one has to back them before IPO, when private, but they are staying private for longer. As Helen Steers, managing partner at Pantheon, pointed out: Just Eat listed in 2014, 13 years after it was founded; Games developer, King.com took 11 years to go public also in 2014; and Skyscanner was founded 14 years before it was sold to a strategic buyer in 2016. All these companies generated very strong returns for their private equity backers.[1]

This partly reflects the explosion of dry-powder and record fundraising within private markets, as investors try to capture this at different stages:

- Early stage VC: high risk of losing capital entirely for the sake of high growth and maximum return (diversification is key);

- Later stage Buyout: pre-IPO; when companies are already at exceedingly high valuations.

The early-stage market is also increasingly competitive, with a different skillset required to help build products and back entrepreneurs.

Growth offers investors high-upside

Growth offers an attractive mix of high upside potential associated with VC as well as the downside protection provided by Buyout. Growth can be defined as investments that showcase the following characteristics: limited or no leverage, a proven business model, high organic revenue growth (a report by Cambridge Associates cites >10%), and clear path to profitability.[2]

CA data showed the higher the revenue growth, the more likely there will be a positive investment outcome. CA data of 2008-17 reveals an average revenue growth rate of 17.2%, more than double the growth rate of buyout companies and more than triple that of public companies. 40% of ‘high-growth’ realised growth equity deals (i.e. CAGR revenue of >20%) produced exits of greater than 3x, and nearly 70% produced exits greater than 2x.

Frog’s portfolio is growing >50%.

At a time with various headwinds (negative consumer and business sentiment, negative government bonds, reported contraction), CA data also showed that Growth equity portfolio companies grew revenue and EBITDA even during the 2007–09 global financial crisis (GFC).

Limited downside risk

At the same time, Growth is proven to provide less downside risk, given such companies have scaled revenues and have achieved product-market fit. Indeed, CA data shows growth equity incurring less loss than VC and close to BO. Growth equity incurs a loss of 13.7% of its capital and earns an overall return on the remaining 86.3%, and BO incurs a loss of 11.7%, compared with VC which is closer to 32.7%.

Moreover, growth equity targets a broader return generated from a wider selection of its portfolio, versus VC which relies upon one or two companies.

Growth equity generated 28% of its total value from investments that returned MOICs greater than 5x, whereas VC relied upon just 8% of invested capital to provide over half of its value.

High fund returns

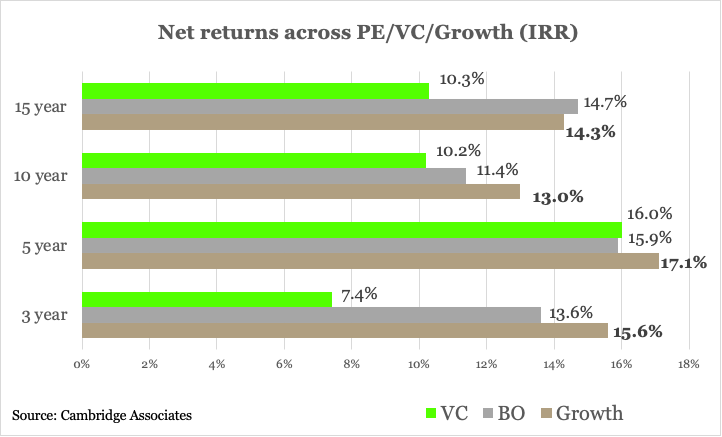

More importantly, high revenue growth and the importance of EBITDA translates into high fund performance. Growth equity pooled rates of return produce a periodic rate of return of 15.6%, 17.1% and 13% over a 3, 5 and 10 year period. This compares favourably with BO and VC, which provide 13.6%, 15.9% and 11.4% and 7.4%, 16% and 10.2% over the same timeframes.

The current European Scale-Up Opportunity

The current Tech ecosystem is thriving. European founders are well catered for; there is no shortage of capital or support from an over-concentrated eco-system of VCs and incubators.

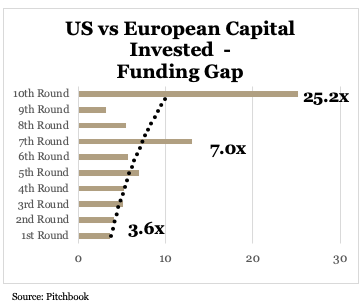

However, in Europe, Scale-up is under-represented in both support and funding. This is made clear when compared with the US. Despite a similar sized economy of $20trn in GDP, companies receive far more capital in the US than in Europe, particularly later on in their life cycle. Again, Pitchbook research shows that the difference between US and European companies increases from 3.6x at the 1st round to 7x at the 5th round and 25x at the 10th round.

Our research also shows a 2.7x increase in the number of companies looking for investment at the late-stage / growth space between 2011-14 and 15-18 (i.e. European software rounds of €5-25m).

Scale-Up Expertise

More importantly, companies require the relevant expertise and support during the Scale-Up stage. Whereas support for founders relies upon capital, introductions and product knowledge; during the Scale-Up phase, the CEO (be it a founder or appointed CEO) and supporting management team often require help addressing a wide number of areas.

Cambridge Associates acknowledges this within the report, ‘Growth equity managers need to be prepared to deliver active post-investment value-add capabilities…’

Specialists are more likely to drive value (and, therefore, returns) given their understanding of the companies and their network.

With a broad range of skill-sets across Venture Capital, Private Equity, founding and leading tech companies and our Scale-Up Methodology, Frog have the foundation to do exactly this.

Source: Growth Equtiy, Turns Out, It’s All About Growth’, Cambridge Associates, 2019

Footnote:

[1] https://www.lapfinvestments.com/2017/10/the-shrinking-public-markets-and-why-this-matters/

[2] Cambridge Associates Growth Equity Report