At Frog we have created a unique methodology to support our CEOs through the challenges of the scale-up phase. The scale-up CEO and the companies they lead have to balance a myriad of competing objectives and therefore need to be both personally and organisationally robust to succeed. Based on these challenges, the third and last element of Frog’s Scale-up Methodology is ‘Resilience’.

Companies we back at Frog will be delivering exceptional growth. As a result, enthusiastic and supportive early stage investors will be clamouring for more of the same. We know from experience that maintaining this growth requires compromises between short and long-term objectives. Getting the right balance between revenue growth, operational infrastructure development and cash management can be difficult. For example, too much focus on revenue growth by over-investing in sales before the market or product is ready can create unacceptably high risk for the founder but may be acceptable to the VC investors pursuing a portfolio value maximising approach.

There is one certainty: the scale-up phase will not go smoothly; the requirement to deliver multiple objectives for customers, staff and investors will test even the best laid plans. At Frog, we have been through this process many times, both at the coal face in executive roles and as active investors. We can provide the expertise to avoid many growth issues with the support of the Scale-up Methodology.

What is the received wisdom on corporate Resilience and what is it about our approach that’s different?

Resilience is rarely spoken about in venture capital circles; anything other than the growth mantra can be criticised as being insufficiently ambitious. We feel that this suits the interest of investors more than executives and founders, and a more balanced approach is required. Frog’s portfolio is focused, and as a result, we are much more aligned with business leaders and founders in assessing appropriate risk and return in a realistic way.

The Scale-up Methodology has three elements within resilience; Value, Funding and Sustainability. We see these as mutually supportive: funding and sustainability provide the platform for the confident pursuit of value creation.

Value

At the early venture capital stage, investors base their judgement largely on high level instinct; the passion and experience of the founders, the size of the market and the innovation of the product approach. At the scale-up stage, the core judgement is whether there is the potential to create a longer term, sustainable and valuable business and to set realistic value creation benchmarks along the way.

An easy way to assess progress is to understand the minimum growth needs after a funding round to justify the post money valuation excluding the cash. The detail is in the notes but based on some heuristics on the relationship between growth and multiple, a £10m round on a 7 times revenue multiple for a £5m revenue business requires revenue to grow by 43% to justify the post money valuation, a £15m round would require 54%. This calculation provides the theoretical minimum required to have a next funding round at an increased valuation.

Another test, irrespective of future plans (for IPO for example) is to identify and understand potential purchasers. If you can assess their strategic rationale for a purchase and see what is valuable to them then you have identified clear value creation benchmarks. Potential purchasers may be looking for scale in a new merging market, new products, market share or proof of international expansion potential.

For small businesses, it will be rare for large purchasers to make an inbound approach unless you make a strategic decision to build your profile and relationships. For many corporates, a commercial relationship will be required before a transaction can be justified. Building multiple relationships keeps options open and gives the best, rounded insight on value creation.

Funding

A successful scale-up will have lots of funding options. A company with few funding options is not likely to succeed. Scale-up company boards must have experience of and network into funding alternatives (internal and external equity rounds, venture debt, working capital facilities, its own customers and ultimately, profits), and should understand the company specific pros and cons of each.

Understanding pros and cons is one thing, successfully ‘pitching’ your story and cultivating robust demand for your offering is quite another. Many scale-up CEOs see fund raising as a necessary evil, an unfortunate diversion. The reality is, if you are going to aggressively grow a business at a loss, being able to engender tangible funding demand is a core skillset.

Understanding the criteria for success for each funding type is critical. It’s important to be mindful that these criteria evolve; a good proposition and team for an early stage round may look very weak to a venture debt or later stage equity provider. Revenue growth is always important for a credible scale-up pitch but so are margins, the maturity of your customer acquisition model, product differentiation and competitive advantage, and evidence of your ability to hire and retain top talent. Exploring funding options from a position of strength is essential, the process should always be run well ahead of a cash requirement. The chances of process delay are high, so timing should assume this is the case and still give enough leeway for the process to complete without getting within six months of the cash out point.

One of the most common mistakes is pitching your story too early to investors who say they are intrigued but don’t shift to being convinced. Thoroughly test the core thesis you are asking your audience to pitch to their investment committee. And thoroughly research their key investment criteria, as a debt provider, corporate investor, scale-up investor will all have very different measures. Finally, don’t underestimate the power of process momentum. Losing it can be fatal, so plan ahead, be properly resourced and keep your interested parties close together in timing

Sustainability

A core part of the Frog philosophy is helping management to build businesses that can become self-sustaining longer term. Ownership may change but the aim is to create a thriving organisation that lasts the test of time as a business entity not just an innovative concept. This builds on all the other elements of the Scale-Up Methodology, especially clarity of annual strategic plans, providing an action plan for executing new growth initiatives and delivering increased market penetration in a well-researched way. The most effective scale-up CEOs drive aggressive growth, not at all costs, but by judging their ability to attract the right level of resource to fuel the plan, thereby keeping the destiny of the business in the hands of the executive team.

Critical to this effort is understanding the options available. For a scale-up company with a core profitable business, the options are open to drive good profitable growth from internal funding or to take external investment to support faster growth and losses, with a clear return on the additional investment. Without strong underlying fundamentals (positive unit economics, clarity on breakeven points, revenue visibility), management will be surviving at the whim of funders, hoping someone will continue to fund the long-term potential, unconcerned that they are funding not just growth investment but underlying losses. It is in the interest of venture capital to promote the success stories of the most risk-loving entrepreneurs as this behaviour suits their broad portfolio approach. The greater number of similarly driven, focused entrepreneurs for whom excessive growth abruptly ended when funding dried up, are rarely mentioned.

Conclusion

Scale-up success is ultimately about personal and company ‘Resilience’, requiring the capacity to avoid or deal with the unforeseen issues that inevitably arise. An investor that is focused on the scale-up phase will have experience in all these areas and if, like Frog, they focus on helping a select portfolio, they will have the available resources and alignment to assist the scale-up CEO in delivering effectively across more areas than they could possibly achieve on their own.

Appendix

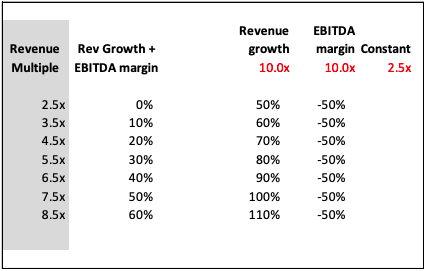

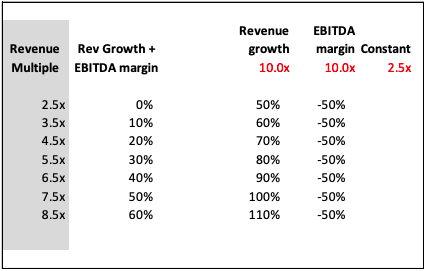

Heuristic based on multiple analyst empirical studies is:

Revenue multiple = 10 times revenue growth plus 10 times EBITDA margin plus 2.5 (constant).

EBITDA is assumed to be a good proxy for free cash flow.

Simply put the revenue multiple is 10 times the net of revenue growth and EBITDA margin plus 2.5.

The range of revenue multiples might therefore look like this:

A £10m raise at 6 times revenue on £5m revenue has a pre-money of £30m and a post money of £40m. This assumes 35% revenue growth plus EBITDA margin. Let’s assume 55% growth and 20% negative EBITDA margin: (10*0.55 + 10*(-0.2) + 2.5 = 6x).

To justify this £40m valuation the business will need to grow at 49% (assuming margins remain constant) which derives revenue of £7.4m and a multiple of 5.4x to support the £40m post money valuation: (10*0.49 + (10*-0.2) + 2.5 = 5.4x).

Essentially this is a position that needs to be reached before the cash runs out so the revenue could be over more than one year but the growth rate that determines the multiple is still the last 12 months so with slower growth the revenue will need to be higher because the multiple will be less.

In the example above if revenue of £7.4m was achieved after two years of even growth the LTM growth would be 22% and the implied multiple is 2.7 times (with no change in EBITDA margin (10*0.22 + 10*(-0.2) + 2.5 = 2.7x) giving a valuation of £20m.

If the slower growth allowed a move to profitability then the position is better as with a 7% positive EBITDA margin the multiple would be back to 5.4 times: (10*0.22 + 10*.07 + 2.5 = 5.4x).